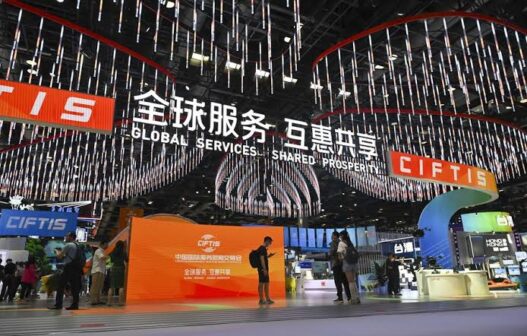

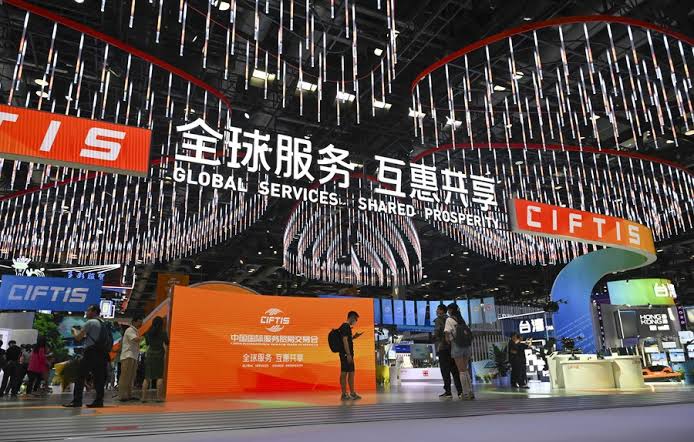

On Friday, China unveiled a strategy aimed at further liberalizing its service sector, which includes plans to eliminate restrictions on foreign equity ratios for app store services.

This initiative is part of China’s efforts to attract increased foreign investment in its rapidly growing services sector, coinciding with government commitments to enhance service consumption as a means of bolstering the economy amidst escalating trade tensions with the United States.

The strategy broadens the range of cities participating in a pilot program designed to liberalize the services sector and outlines objectives such as accelerating the industrial application of artificial intelligence technologies, as detailed in a document released by the Ministry of Commerce.

Additionally, China will open its value-added telecommunications and related digital services to foreign investors and will work towards liberalizing the medical and healthcare sectors, as stated in the document.

The country will also permit financial institutions to broaden their business activities, facilitating multinational companies that invest or establish a presence locally to engage in cross-border centralized fund operations in yuan. Furthermore, it will enhance the pilot program for the Qualified Foreign Limited Partner (QFLP) initiative.

Launched in 2010, the QFLP allows foreign investors to participate in China’s private equity market through a limited partnership framework.

Moreover, China will encourage the involvement of both domestic and foreign commercial banks and insurance companies in trading yuan treasury bond futures for risk management purposes.